Oil price forecast 2021-2050

History of oil prices

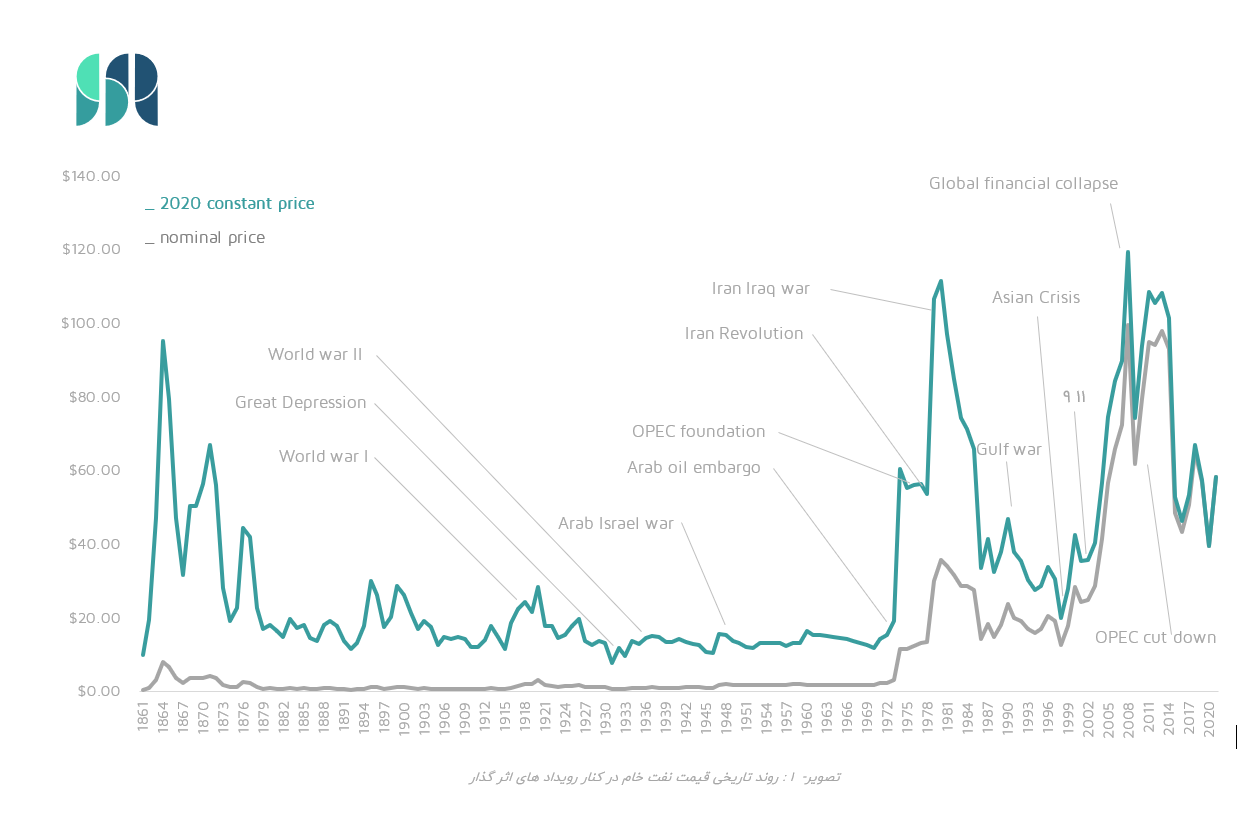

We know supply and demand forces can shape the oil prices chart, but two other strong factors affected oil prices. With a glance at the history of oil prices, these factors can be seen clearly.

- Wars

- Economic crises

The effects of the above factors depend on whether it targets the supply side or the demand side, which could be far different. For example, September 11, pushed down oil prices because it happened in a country that consumes crude oil and crude oil consumption is expected to fall. On the other hand, the war in Iraq and Kuwait and the Arab-Israel war have led to an increase in the price of crude oil because it has disrupted the security of oil supply.

historical oil price and political events

Therefore, it will not be an easy job to forecast the long-term crude oil prices. But assuming the elimination of war and deep crises from the equations, it is easier to picture the general and long-term trend in crude oil prices.

Main Factors on Oil Prices

Given the above assumption, the factors affecting oil prices can be categorized as follows:

- Population growth

- Global economic growth

- Supply and demand of crude oil

- Growth of renewable energy

- International requirements for reducing carbon emissions

Oil Price Forecasting Methods

Crude oil price forecasting methods are divided into three general categories:

- Econometric method

- Machine learning and neural network method

- Innovative methods

The innovative approach is mainly based on surveys, professional knowledge, experiences, ideas, and insights. One of the methods of the innovative approach is based on “no change”, in which the current price is considered the best forecast for the future. This method, despite its simplicity, has proven to be more effective than other innovative methods. Methods based on econometrics and machine learning make more accurate predictions. Although the problem for both groups is that they are retrospective in predicting the future. (Source)

Assumptions

· Population growth

The population in 2050 is estimated at 9.7 to 9.9 billion, according to UN and other independent studies. Besides, according to studies, population growth will stop by about 11 billion by 2100. Currently, the average global population growth rate is about 0.8%, which will reach zero by 2100. The current population of the earth is 7.9 billion.

25% population growth by 2050

· Global economic growth

According to the World Bank, GDP at the end of 2020 was 4.5 percent lower than at end of 2019. According to reliable forecasts, global GDP (base scenario) will be $ 100 trillion by 2025 and $ 176 trillion by 2050. (Source)

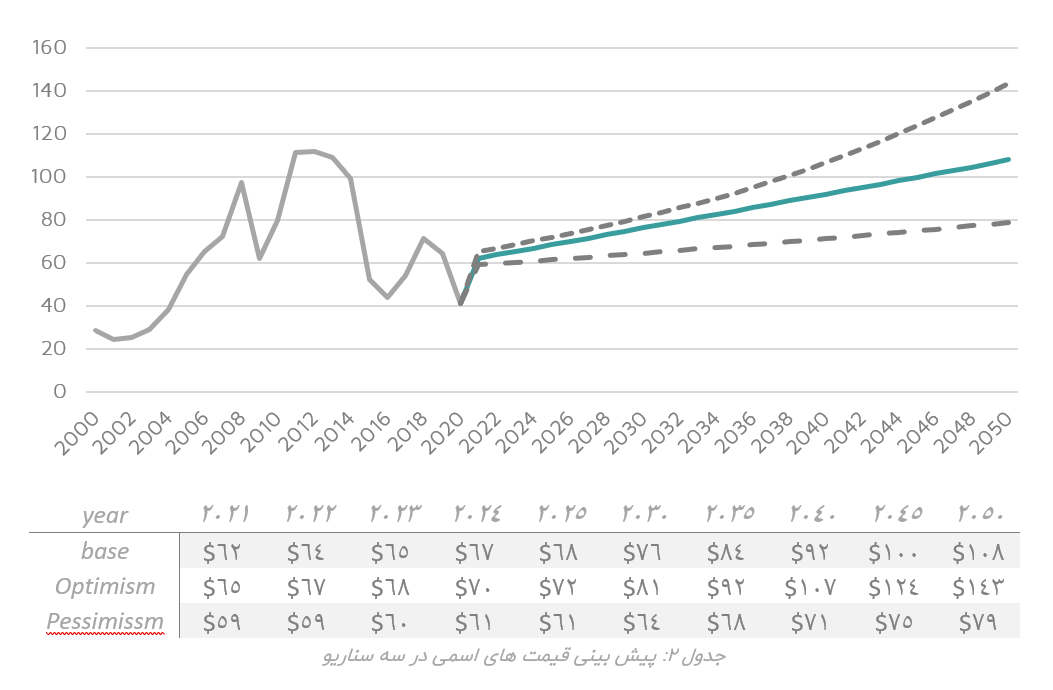

The chart below illustrates the growth of global GDP with three scenarios: pessimistic, basic, and optimistic. The average growth rates of each scenario are 1.5%, 2.5%, and 3.5%, respectively.

110% world economic growth by 2050

· Demand of crude oil

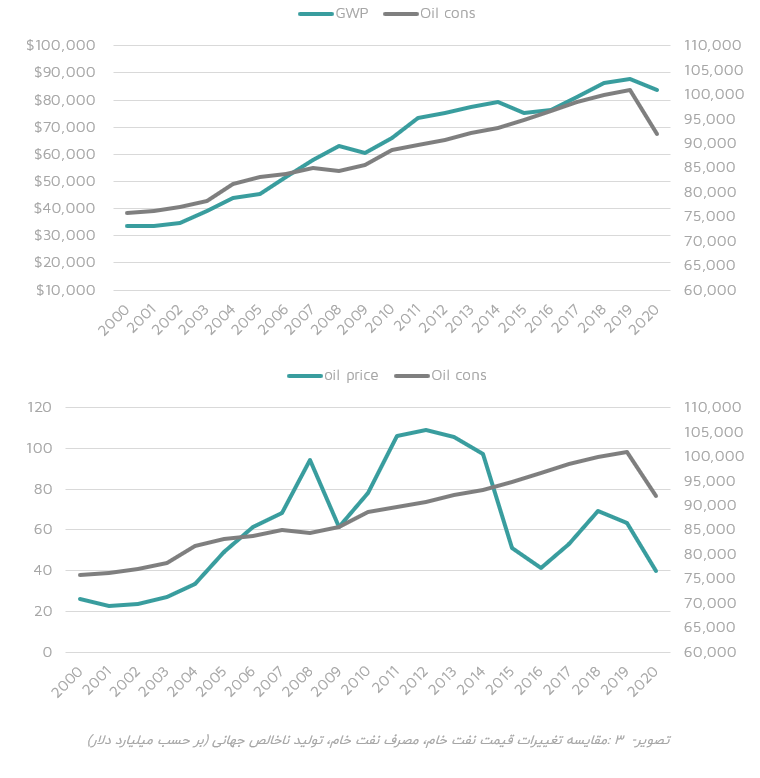

Despite the sharp fluctuations in crude oil prices, demand of oil shows a more stable trend. According to the charts below, crude oil demand is more affected by economic growth than its price. The average global GDP growth (GWP) from 2000 to 2020 was 4.8% and the average growth of crude oil consumption in the same period was 1%.

compering oil price, oil consumption, and global GDP- figures in B$ – BP reports

It should be noted that although the share of oil in the international energy basket is declining, its growth is still positive and until the growth of oil consumption is not negative, the phenomenon of peak oil will not appear, which according to economic growth (2.5%), and population growth (0.7%) in the 2050 horizon is justified.

On the other hand, if due to the phenomenon of oil peak, (oil demand decreases) the price of oil decreases and again becomes a cheap source for various industries, so the demand and its value increase again.

Furthermore, previous false predictions on peak oil create the impression that the oil peak theory has become a subversive prediction (self-destruct prediction), and analysts at the end of each false forecast, bring reasons to explain why it didn’t happen. The reason these predictions didn’t come true is that the predictions are retrospective, while the future is made with future tools. So, based on the all above statements, we don’t consider the oil peak in our study.

Oil price forecast

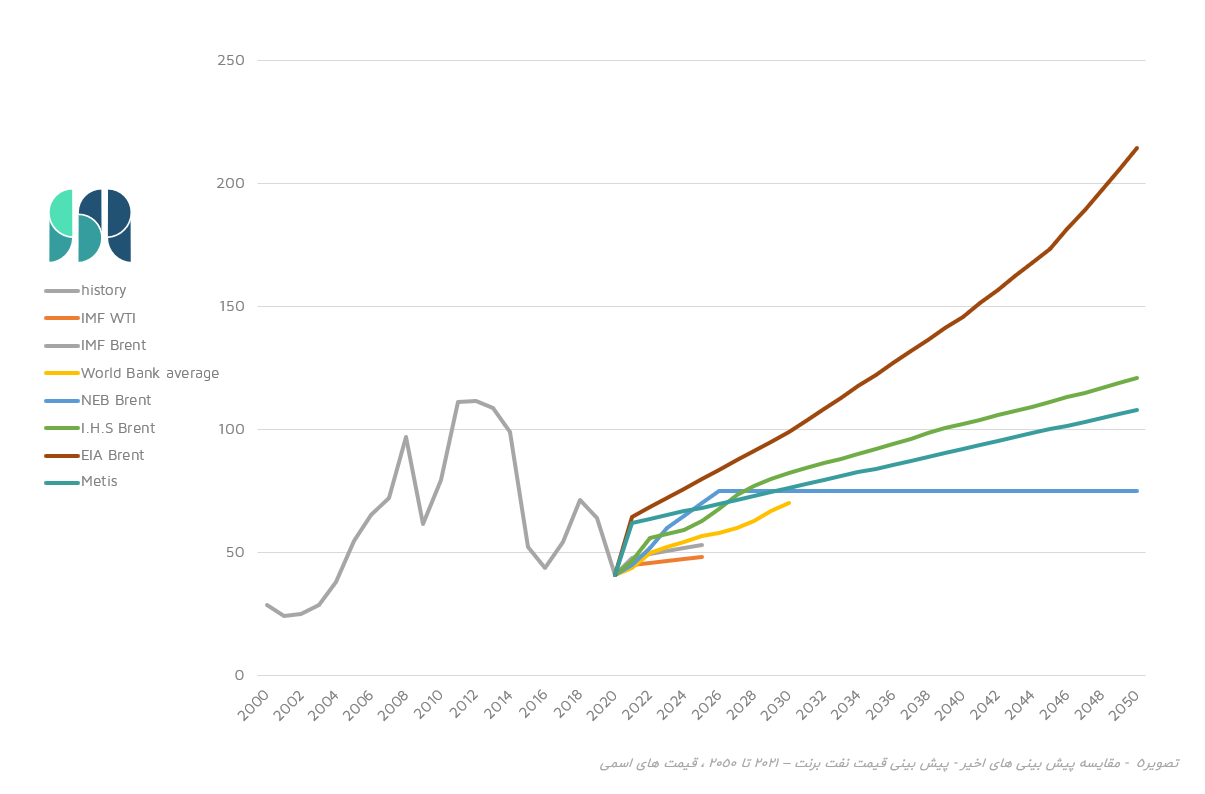

Global Forecasts

According to the short-term forecast of the Energy Information Administration (EIA) published on April 6, 2021, the price of Brent oil for the second quarter of the year is estimated at $ 65 and for the second half of 2021 $ 61. The EIA forecasts the nominal price of Brent oil for the future as follows:

- By 2025, $ 66

- By 2030, $ 89

- By 2040, $ 132

- By 2050, $ 185

In a report released by Rigzone magazine on March 4, 2021, Brent oil averaged $ 64 for 2021, $ 5 higher than the previous forecast. This is how the report predicted the far years:

- 2022, $ 63

- 2023, $ 67

- 2024, $ 70

- 2025, $ 72

Bloomberg Brent oil prices for 2021 is $ 56 and

- 2022, $ 58.2

- 2023, $ 60

- 2024, $ 63

- 2025, $ 62

At the end of January 2021, the OilPrice website forecasts the average WTI price for 2021 to be between 50 and 55.

The International Energy Agency (IEA) predicts in an oil market report released in March 2021 that oil consumption will recover 60% drop in 2020 to 5.5 million barrels and return to 2019 production levels in 2023. The agency forecasts WTI at $ 58.9 and Brent at $ 62.3 for 2021. It also forecasts 2022 at $ 56.7 and $ 60.5, respectively.

FXempire analysis on April 14, 2021, forecasts US short-term oil prices at $ 65 (current price $ 62) and North Sea oil prices at $ 67 (current price $ 65).

Results

Price of the day

The current price of one barrel of crude oil is as shown in the table below:

Table 1 : benchmark oil prices – (Iran prices delivery in Mediterranean) – April 20 2021- Oilprice.com

| type | Price ($/bbl) |

| Brent | 64 |

| WTI | 68 |

| OPEC basket | 65 |

| Dubai | 63 |

| Iran light | 64 |

| Iran heavy | 62 |

| Iran Forozan blend | 62 |

Short Term and Mid Term

The average Brent price for the second quarter of 2021 is projected at $ 65, and for the second quarter of the year due to seasonal decline in transportation demand is forecast at $ 61.

Our forecast for the 2021 average is $ 62. For 2022 and 2023, we forecast $ 63 and $ 65, respectively.

nominal price forecast in three scenarios

Comparison of recent forecasts – Brent oil price forecast – 2021 to 2050, nominal prices

Download the oil price forecast 2021 – 2050 pdf

Publications & Reports

Iran’s culture (languages, religion, calendar, arts, foods, history)

Be sure to read the following:

TEHRAN – Iranian Parliament Speaker Ali Larijani who was on tour of Tokyo proposed on Tuesday that there are great opportunities for Japan to invest in Iran. “There are suitable...

Iran's economy status: In this article, we will discuss some important economic factors in Iran. These factors include GDP, unemployment, inflation, interest rate, and the exchange rate that are important...

Iran's culture : Iran is a southwest Asia Country, neighboring Turkmenistan, Azerbaijan and Armenia on the north, Afghanistan and Pakistan on the east, and Turkey and Iraq on the west....

The First Female Leader of WTO [caption id="attachment_1919" align="aligncenter" width="403"] Ngozi Okonjo-Iweala[/caption] Who is she? The First Female Leader of WTO: Okonjo-Iweala was born in Ogwashi-Ukwu, Delta State, Nigeria, where...

Iran's economy and US election 2020. Although polling is an inexact science, particularly in Iran, it still gives us a glimpse into Iranian opinion. According to a poll conducted by...

Iran's Culture: Every country has its own customs and traditions. Iran is no exception to this rule, habits, however small, that are passed down from generation to generation. Culture is...

General Characteristics About Iran: Iran located in Southwest Asia and the Middle East. Iran is bound by the Gulf of Oman and the Persian Gulf to the south and the...

What has been happening for women in the Black Market of IRAN during COVID-19? What is the Black market, underground or shadow economy ? [caption id="attachment_1885" align="alignleft" width="300"] Iran's economy[/caption]...

Iran's Inflation Forecast Results Iran’s Inflation in different sectors until March 2023: The inflation rate until the end of March 2023 according to the below table is forecasted at 37.6%[1]...

Women’s status in the Black Market of IRAN What has been happening for women in the Black Market of IRAN during COVID-19? (part2) Although in the previous article we examined...

Fuel Smuggling in the borders of Iran six million liters of diesel and paraffin oil are smuggled from Iran to Pakistan every single day. Unemployment, drought, and the low price...

Fuel smuggling Smuggling is a phenomenon that destroys infrastructure and the long-term economic goals of the government, and in the meantime, the main losses will be borne by the people...